If you want to know if you can sell your house in Dallas when behind on payments, Simple House Solutions can help you. We provide tips and solutions for your problems like how to catch up if you are behind your mortgage payments. Learn more options in this article.

Simple House Solutions Answers the Question: Can You Sell Your House in Dallas When Behind On Payments

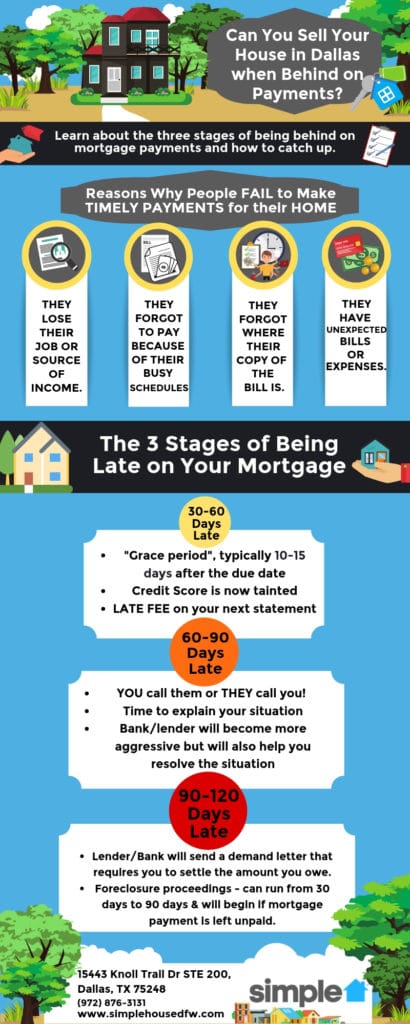

- They lose their job or source of income.

- They forgot because of their busy schedule.

- They forgot where their copy of the bill is.

- They have unexpected bills or expenses

When you search the Internet for tips on how to sell your house when behind on mortgage payments, you may find so much it is overwhelming. It is easy to believe and trust in them.

You have to make sure that you seek help from a reliable company. At Simple House Solutions, we have helped many people with different situations who want to sell their homes in Dallas while behind on their payments. We look at all your options, and try to find solutions that will help you climb out of a hole the way you need and want to.

You have to make sure that you seek help from a reliable company. At Simple House Solutions, we have helped many people with different situations who want to sell their homes in Dallas while behind on their payments. We look at all your options, and try to find solutions that will help you climb out of a hole the way you need and want to.

The 3 Stages of Being Late on Your Mortgage

There are three stages to being late on your mortgage: 30-60 days, 60-90 days, and 90-120 days. At each stage, you’ll have different options available based on your bank or lender.

30-60 Days Late

Every lend holder, it could be your bank, Chase, or Wells Fargo, it could be anybody, has different rules. However, when you are 30 to 60 days late, do not think it is the end of the world. You can still catch up!

Banks are going to put fees on it but the minute your credits already gained at that point. People need to know that, but you still have time to catch up.

60-90 Days Late

If you continue to miss the payment, you will 60-90 days late. At day 90, you will probably pick up the phone and call the bank.

90-120 Days Late

Day 90 or day 120, it is a little bit different. They are going to say look you have already passed this point. You have to pay the total amount to catch up, and if you do not pay the full amount, I will send your money back, and we’re actually going to start foreclosure, and that can literally be another 30 days, 60 days, or 90 days. It just depends. You have to call your bank.

How Simple House Solutions Can Help Sell Your House in Dallas When You’re Behind Mortgage Payment

If you got a letter from us or you have contacted us, this is all public records. We pull that information because we want to help. We want to let you know that do not have to go through this on your own. It is not your fault; you did not do anything wrong.

There is a process that banks go through when you fall behind your mortgage. What you want to do is know where you are in the process, and no matter where you are in the process, you can always say, “Look, I’m done with this please help me.”

Your Options Are Based on Your Situation

Each situation is unique, and depending on yours you may have access to one or all four of the below options:

- Cash offer

- Rent it out

- Work withabank

- Start pre-foreclosure

Option 1: Cash Offer

Option 1: Cash Offer

When you are behind your payments, do not be disappointed. You may opt for the easy button, which is the cash offer. We buy houses in any condition, so you do not have to worry whether it is old or brand new. You do not have to fix repairs nor do any preparation before putting your property in the market. This option will save you from the hassle of finding a realtor and selling your house.

We try to make this option available in all stages. Depending on your situation, how much you owe may make selling a great idea or a bad idea: either way we take the time to look and see. Once the bank steps in to foreclose on the home, cash offer options are taken off the table.

Option 2: Rent it Out

You can also do the second option, which is to rent it if you have extra cash reserved. This option will benefit you because it will give you extra income that will help you catch up on your mortgage payments. When renting your home, it is a smart idea to think about these two factors:

- You have an affordable place to stay

- You rent it at or more than your mortgage payment

Renting your home out is the best option when you are in the 30-60 day stage because you still have time to catch-up. Once you get more than a couple of months behind the fees and debt make it difficult to catch up by renting out your home.

Option 3: Work with a Bank

You can still sell your house in Dallas once you get to 60 days or 90 days behind your mortgage payment. The average mortgage in Dallas, Texas, is about $1400.

Therefore, if you are 60 days behind with fees, you might be upwards of $3,000, and the bank will work with you. Make sure you are communicating with your bank because they are in control of your mortgage and deals. Unfortunately, we’re not able to communicate with the bank on your behalf.

Start Pre-foreclosure

Pre-foreclosure starts after 120 days late payment. Keep in mind that foreclosure is a long process. The bank can determine at anytime when they want to step in and foreclose a home. We may not be able to control the banks, but we can provide options to you before this happens. We don’t want you to lose your home if you don’t want to, and if you do need to sell we want to give you control of that.

Not Sure if You Can Sell Your House in Dallas When Behind Mortgage Payments?

At Simple House Solutions, we will never come out there and tell you what to do. It is not our lives. Our job is to come out there, be a solution for you, and see how we can help. We are going to walk you through our options and see if any one of those has an appeal to you. You can start anytime you want. We will never make you do something or ask, or tell you to ask us what we will do. Instead, we will tell you the pros and cons of each option, but we never want to be in a position to tell you what to do.

Can you sell your house in Dallas when behind your mortgage payments? Yes, you can! Simple House Solutions, one of the top-notch providers of home solutions, offers useful options. Need help? Talk to one of our specialists at (972) 876-3131!